A little more than 10 years ago, in response to a shift in financing methods, the concept of initial coin offerings, also known as ICOs, was introduced in the cryptocurrency field. To answer your question, “When was the First ICO History held?” For this piece, we will take you back to 2013, when the first initial coin offering (ICO) happened. In addition, we will discuss the challenges that these initial coin offerings have brought about, as well as the impact that they have had on the current landscape of online fundraising.

When Was the First ICO? Mastercoin Cue

J.R. Willett, superintendent among many, must vigorously support the first ICO with his Mastercoin (now Omni). With ‘The Second Bitcoin White Paper,’ Willett started the 2012 ICO. In that white paper, he described Bitcoin blockchain-based technology. Willlet mentioned the initial coin offering in the whitepaper to fund new cryptocurrency projects. At the 2013 Mastercoin ICO, Willett raised USD$500,000 in Bitcoin, his most outstanding achievement. Willett could access the Bitcoin community directly through this ICO, unlike traditional fundraising techniques, which include legalities, bureaucracy, and intermediaries.

Investing in Mastercoin tokens aimed to improve Bitcoin by enabling digital contracts and decentralized blockchain applications. The First ICO History, the Mastercoin ICO, was the first public issuance of tokens to support a blockchain project and is considered a milestone in cryptocurrencies. Its uniqueness lay in its reliance on technical innovation to promote its product, rather than a cryptocurrency quid pro quo into hard-capital-value-backed schemes that would become the norm in ICOs.

Mastercoin’s ICO: A New Fundraising Strategy

The success of Mastercoin’s cryptocurrency initial coin offerings (ICOs) played a significant role in the inception of the ICO phenomenon. It raised funds using Bitcoin in a transparent and decentralized manner, offering a straightforward solution to the First ICO history. This development opened the door for a new class of blockchain enterprises to raise capital. With ICOs, companies could raise money without giving up ownership and with much less regulation than traditional IPOs, which require giving up stock and are subject to strict regulatory scrutiny. This appealed to developers and business owners who found traditional finance methods too complex.

This was incredibly alluring. Mastercoin’s unique feature was its capacity to raise money directly from the community by leveraging decentralization and blockchain technology. With this strategy, early-stage cryptocurrencies were able to establish a strong bond with their supporters and cultivate a more active and committed user base. The ICO model gained popularity and became the standard approach for raising money in the cryptocurrency and blockchain sectors.

What Makes ICOs Different from IPOs

Although initial public offerings (IPOs) and initial coin offerings (ICOs) are both methods of obtaining cash, each concept is somewhat different. The rise of ICOs as a fundraising technique is frequently likened to IPOs. To summarize the distinctions, below is a list:

- Equity vs. Tokens: ICOs offer tokens for access or usage rather than ownership, whereas IPOs purchase corporate shares and confer ownership.

- Regulation: Authorities like the SEC oversee IPOs to safeguard investors; ICOs are not regulated, which puts them in danger of fraud.

- Ownership: IPO founders give up control and equity, but ICO founders keep complete control without transferring ownership.

- Investment Process: By allowing direct participation using cryptocurrencies like Ethereum, initial coin offerings (ICOs) eliminate the need for middlemen like brokers in share transactions.

Initial coin offerings (ICOs), which are similar to initial public offerings (IPOs), typically follow a multi-stage funding process. This process typically comprises private sales, pre-ICOs, and the actual ICO itself, with each step offering different levels of access and perks for early investors.

Mastercoin, Ethereum, and Beyond ICO Mania

Mastercoin’s successful ICO triggered a veritable boom in cryptocurrency fundraising. Other projects, household-a-whiff-of-the-possibilities, held their ICOs in the same manner, with Ethereum itself selling its ICO for about $18 million in 2014. Such a breakthrough in ICO fundraising positioned Ethereum alongside the core principle of smart contracts, once again adding credence to the concept of future decentralized initiatives channeling funds through ICOs to realize their technological uses.

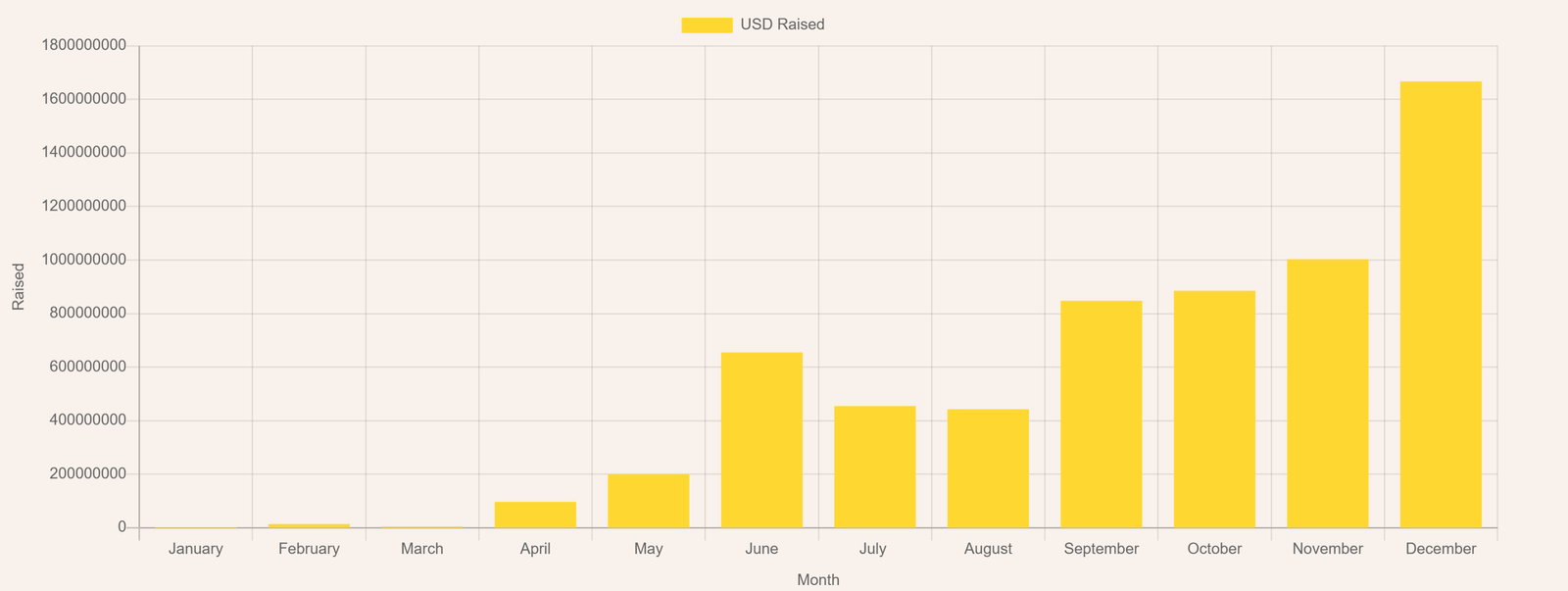

The success of the Ethereum ICO transformed raising funds through ICOs from an experimental approach into the quintessential funding method for blockchain projects. By 2017, thousands of ICOs had launched and raised billions of dollars. Coin Insider shows that around 252 ICOs raised roughly $5.7 billion in 2017, while more than 1600 projects raised approximately $13.6 billion in 2018.

ICOs’ Downside: Scams and Regulation

Furthermore, the boom in ICOs also attracted its share of unscrupulous characters. Many simply did not keep their word, while others were outright frauds. Which only led to more scrutiny from regulators. Around the world, governments have become concerned with ICOs; while some have wholly disallowed them, others have instituted new regulations. The SEC warned the public about potential scams and classified many tokens as unregistered securities.

This caused a shift in the general public’s and various states’ focus on the need to regulate and scrutinize the projects that failed to comply with current global regulations. At such a time, ICOs became a massive boon in facilitating investment for various cryptocurrency startups, creating lucrative prospects for investors and developers. Apart from ICOs, IEOs are the best alternatives. Awe-inspiring IEOs and STOs regulate this movement of raising funds. However, ICOs drastically shaped the fundraising model for blockchain projects.

In Summary

The first ICO History originates from Mastercoin, the first public token sale of a blockchain-oriented initiative. This successful ICO opened the door for a new type of fundraising, allowing blockchain projects to bypass traditional financial settings and connect directly with the cryptocurrency community. In this sense, ICOs have transformed how projects secure funding; while traditional IPOs can become a challenge for many,

An ICO brings hope to incoming projects to circumvent and leap over hurdles. ICOs have made fundraising much more viable for newer projects, enabling endeavors and inviting investors to the digital economy. Regulatory challenges and fraudulent access continue to challenge progress. The debut ICO, Mastercoin, is a pivotal moment to contemplate when understanding the fundraising shift within the blockchain domain.