Few names in cryptocurrency and tech stocks have generated as much excitement—and controversy—as MicroStrategy. The business intelligence company, known for its aggressive Bitcoin strategy, has seen its stock price rise and fall in pump-and-dump fashion. Retail investors may worry about being left holding the bag. This article will explain MicroStrategy’s stock volatility, pump-and-dump schemes, and whether retail investors are trapped in speculative trading. We’ll also examine if MSTR stock will benefit from its Bitcoin gamble or continue to fall.

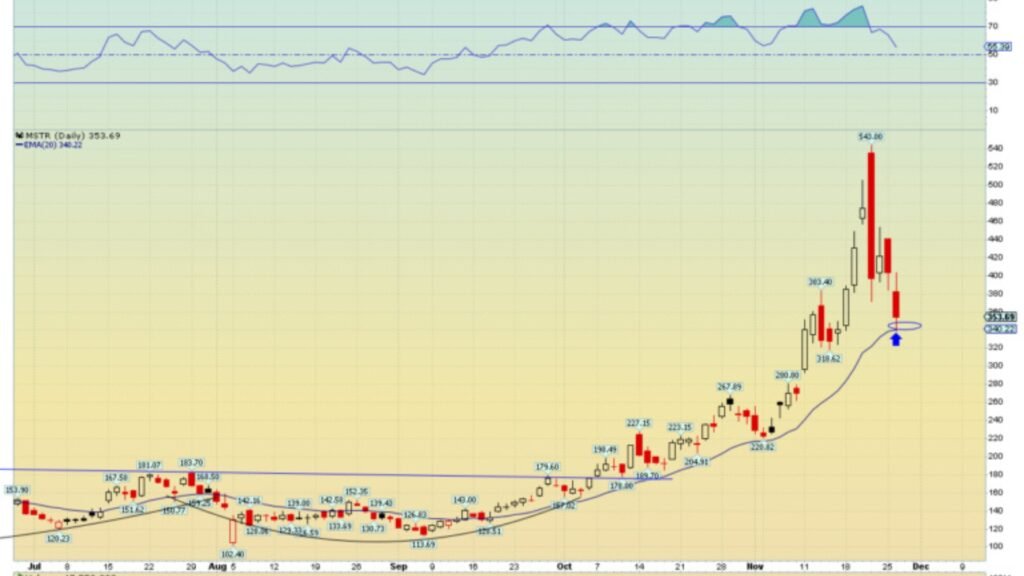

MicroStrategy stock fell 12% on Tuesday to $353. MicroStrategy (NASDAQ: MSTR) has fallen 35% in five days from its November 21 peak. Bitcoin’s slide to $92,000 adds selling pressure on MSTR in a pump-and-dump for regular investors.

Understanding MicroStrategy Stock Movement

In 2020, MicroStrategy CEO Michael Saylor revealed that the business would start accumulating Bitcoin as its principal treasury asset, shedding new light on its volatile stock. Since then, the company has gathered over 120,000 BTC, and its stock price has tracked Bitcoin. MicroStrategy’s shares rose significantly in late 2020 and early 2021, contributing to the MSTR stock pump as Bitcoin surged. MSTR shares peaked at over $10 billion. However, when Bitcoin’s price fell, MicroStrategy’s stock also declined, raising questions about whether retail investors were in for a wild ride or a severe crash.

What is a Pump and Dump?

In a “pump-and-dump” scheme, a stock or asset is inflated to lure naive investors, then sold for a profit. Retail investors sometimes buy during the price spike but see it plummet when the orchestrators leave. Retail investors may have been sucked into a speculative frenzy by MicroStrategy’s high volatility and significant correlation with Bitcoin’s price. No evidence suggests insiders manipulated the stock in a pump-and-dump operation.

Bitcoin’s Impact on MicroStrategy Volatility

The company’s decision to hold Bitcoin as its main treasury asset has led to a special circumstance in which MicroStrategy’s stock price is directly impacted by the price of Bitcoin. MSTR varies in value in tandem with Bitcoin. For instance, the market’s excitement regarding Bitcoin as a store of value was reflected in MSTR’s shares, which surged in value in 2021. However, MicroStrategy’s stock also suffered as the price of Bitcoin started to decline in 2022 and 2023.

MicroStrategy Stock Drops Along With Bitcoin

As opposed to merely being a trader, MicroStrategy is a firm that has made Bitcoin a fundamental component of its whole strategy. The company’s approach to treasury management includes the use of bitcoin as a hedge against inflation in fiat currency, and CEO Michael Saylor is confident that the value of bitcoin will continue to climb. The company is more sensitive to changes in the market as a result of this strategy. If the value of Bitcoin falls below specific levels.

It may be difficult for MicroStrategy to manage its balance sheet, which is heavily weighted in cryptocurrency. Stockholders may be put under pressure as a result of the company’s dependence on Bitcoin’s long-term success, particularly those who are not adequately prepared for volatility.

MicroStrategy’s Long-Term Bet On Bitcoin

MicroStrategy is a corporation that has made Bitcoin a cornerstone of its strategy, not just a trader. Bitcoin is used as a hedge against fiat currency inflation in the company’s treasury management approach, and CEO Michael Saylor believes it will rise. This strategy makes the company sensitive to market changes. MicroStrategy’s cryptocurrency-heavy balance sheet may be tough to manage if Bitcoin’s value dips below certain thresholds. The company’s reliance on Bitcoin’s long-term success may also squeeze stockholders, especially those unprepared for volatility.

Where Is MSTR Heading Next?

An MSTR Stock Pump of 35% from its peak has investors worried. Tuesday’s MSTR 20-day EMA nears session lows. Traderstewie expects tomorrow’s session to rise or fall. If MSTR opens higher, a wise investor forecasts a brief gap fill and robust rebound. Marathon Digital (MARA) beats MSTR, say experts. The price reduction angered MicroStrategy and Bitcoin skeptic Peter Schiff. Schiff: The company revealed its $42 billion three-year Bitcoin buying strategy four weeks ago. MSTR spends $10bn. At current rate, the three-year plan takes 16 weeks. Buyers might expect Bitcoin and MSTR to fall.

Also Read : Smart MSTR Bitcoin Holdings And Solid Business Fundamentals

In summary

The volatility of MicroStrategy’s stock (MSTR) and its strong association with Bitcoin prices worry regular investors. MicroStrategy’s stock price has fluctuated sharply since it adopted Bitcoin as its principal treasury asset. The company’s stock surged after acquiring over 120,000 BTC in 2020. However, Bitcoin’s recent collapse has caused MSTR to tumble 35% from its November peak. These wild price oscillations raise concerns of a potential ‘MSTR Stock Pump and Dump,’ though there is no evidence of insider manipulation driving this volatility.

Since Bitcoin’s volatility affects MSTR’s value, retail investors involved in speculative trading may be at risk. Although some analysts expect MSTR to improve, its reliance on Bitcoin’s performance raises concerns about its long-term viability. Its market-focused Bitcoin approach makes MicroStrategy exposed to market downturns, leaving investors worried about its future.

FAQs

Is MicroStrategy's stock a pump-and-dump scheme?

While MicroStrategy's stock has exhibited pump-and-dump-like volatility, there is no evidence of insider manipulation. The price fluctuations are primarily due to its heavy reliance on Bitcoin's performance.

Why does MicroStrategy's stock move in tandem with Bitcoin?

MicroStrategy holds a large amount of Bitcoin as a core asset, making its stock price closely follow Bitcoin's fluctuations. As Bitcoin rises or falls, so does MicroStrategy's stock value.

Can retail investors expect a rebound in MicroStrategy's stock?

Some analysts expect a rebound, but MicroStrategy's dependence on Bitcoin’s price means that any recovery is tied to Bitcoin’s long-term stability, leaving retail investors at risk if Bitcoin continues to decline.

What risks do retail investors face with MicroStrategy stock?

Retail investors are exposed to high volatility due to MicroStrategy’s Bitcoin strategy. If Bitcoin’s price drops significantly, the company’s stock could continue to decline, putting investors at risk of losses.