Bitcoin is a top investment as the cryptocurrency revolution continues.World’s largest asset manager BlackRock witnessed no flows. Higher inflows into other spot BTC ETFs can boost Bitcoin prices. This weekend, multiple strong variables could push Bitcoin to this massive valuation.A combination of optimistic factors is pushing bitcoin price to a historic high. Three main reasons BTC could reach $100,000 this week.

Bitcoin remains a top investment as the cryptocurrency revolution continues to gain momentum. Notably, the world’s largest asset manager, BlackRock, has yet to witness significant inflows into its Bitcoin ETFs. This weekend, a combination of multiple strong variables could potentially propel Bitcoin to this massive valuation.

Institutional Adoption Bitcoin

The global economic environment is currently tipping the scales in Bitcoin’s favor. Inflation remains a significant concern in many countries, prompting investors to seek safe-haven assets. This creates an environment of low confidence in fiat currencies, driving demand for Bitcoin.

Corporate giants are doubling down on Bitcoin. MicroStrategy, a long-time Bitcoin proponent, recently add to its reserves, bringing its total holdings to 386,700 BTC. Bitcoin Could Reach : Metaplanet, a Japanese public company, announced plans to raise ¥9.5 billion ($62 million) to increase its Bitcoin holdings. This wave of corporate adoption reflects growing belief in Bitcoin’s potential as a long-term store of value.

Macroeconomic conditions in 2024 favor Bitcoin, laying the groundwork for a $100,000 price rise this weekend. Inflation and fiat currency stability concerns are driving investors to alternative assets as economic hedges. To sustain fragile economies, central banks globally maintain loose monetary policies, devaluing fiat currencies. Geographical tensions and financial instability in some regions are enhancing Bitcoin’s appeal as a borderless, secure asset.

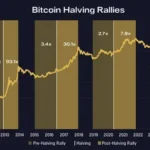

Bitcoin Halving Hype and Reduced Supply

Bitcoin’s halving event in April 2024 has created a supply shock in the market. This event, which occurs approximately every four years, reduces the rewards miners receive for validating transactions, effectively cutting the rate at which new Bitcoin enters circulation.

Currently, the supply-demand dynamics strongly favor Bitcoin’s price growth. As retail and institutional investors rush to acquire the asset, the reduced availability is driving up prices. With this weekend’s trading activity potentially surging, it wouldn’t be surprising to see Bitcoin break past the $100,000 threshold.

Switzerland recently passed legislation to explore how Bitcoin mining can balance the power grid and utilize wasted energy, marking a progressive stance toward crypto integration. President-elect Donald Trump announced the creation of a Bitcoin strategic reserve, which aims to acquire up to 1 million BTC. Such pro-Bitcoin policies from influential nations and leaders provide a robust foundation for BTC price growth.

Read More : Bitcoin experts call the $93K drop the ‘last flush’ before the rush

Conclusion

The convergence of institutional adoption, favorable macroeconomic conditions, and the effects of the Bitcoin halving create a perfect storm for Bitcoin’s price surge. For investors and enthusiasts, this could mark a pivotal moment in Bitcoin’s journey to mainstream acceptance.

Bitcoin Could Reach : Three compelling variables might push Bitcoin beyond $100,000 this weekend. First, Bitcoin ETFs and corporate integrations by BlackRock, Fidelity, and JPMorgan have increased institutional acceptance to record levels. Institutional capital increases liquidity and shows confidence in Bitcoin’s future as an asset class.

Second, global macroeconomics favor Bitcoin. Inflation and declining fiat currencies are driving investors to alternative assets. Bitcoin usually rises after halving, and this cycle is no exception. Demand exceeds supply, increasing the likelihood of a dramatic price breakout. Bitcoin Could Reach: milestone will signify a critical price point and reinforce Bitcoin’s role as a global financial system cornerstone.

[sp_easyaccordion id=”2442″]