Tron (TRX), a cryptocurrency platform known for its ambitious dApps and DeFi ecosystem, has recently demonstrated troubling Sharpe ratio developments. Investors and analysts are closely monitoring these developments since this high spike in the Sharpe ratio could imply volatility and a price crash. But is it a warning indication or just a market fluctuation? This essay examines Tron’s rising Sharpe ratio, its effects on TRX, and whether a price correction or crash is likely.

Measurements Of Sharpe Ratio Tron?

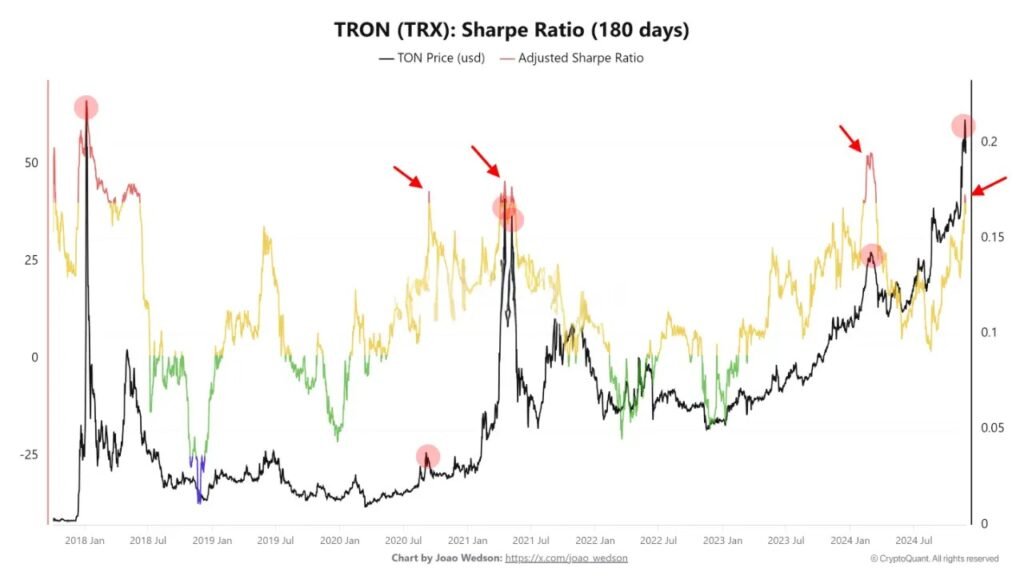

The Sharpe ratio assesses investment risk-adjusted return. It helps investors determine if an asset’s gains are from smart or risky investing. The risk-free rate (usually government bonds) is removed from the asset’s return and divided by its standard deviation to calculate the ratio. Tron (TRX) has a high Sharpe ratio, indicating significant risk-reward. If the ratio is high, the asset’s price may be too volatile and risks may outweigh returns. Market analysts fear a price crash due to TRX’s Sharpe ratio change.

Sharp Ratio Suggests Overheating TRON

A CryptoQuant Quicktake analyst reported a red 180-day Tron Sharpe Ratio. Sharp analyzes asset returns and risk. Divide projected return minus risk-free rate by volatility to examine investments—risky commodity earnings. Quant reported Tron’s five-year 180-day Sharpe Ratio. See the 180-day ‘red’ Tron Sharpe Ratio graph. Quant charts recently exceeded this zone. High-TRX signals. Tron has returned to this high-risk zone.

But the indicator is lower than at previous tops, so it may not top soon. 180-day Sharpe CryptoQuant forum expert Maartunn detected a large Tron USDT supply rise for BitCoin and X. USDT supply jumped 37% to $65.7 billion from $47.75 billion last year. A stablecoin network gains popularity.

But the indicator is lower than at previous tops, so it may not top soon. 180-day Sharpe CryptoQuant forum expert Maartunn detected a large Tron USDT supply rise for BitCoin and X. USDT supply jumped 37% to $65.7 billion from $47.75 billion last year. A stablecoin network gains popularity.

TRX Price

TRX (Tron), a Tron Foundation cryptocurrency, is fast and cheap. Recent market sentiment and Tron ecosystem developments have caused TRX price volatility. Tron’s decentralized network lets content creators share directly, transforming entertainment. Bitcoin is popular despite its volatility like many altcoins due to its ambition. Global economic factors, blockchain network rivalry, and Tron network upgrades or partnerships affect pricing. The scalability and decentralization of TRX attract developers and individual investors. Its dedicated users have kept it on top of the crypto market despite price changes.

Tron’s Price Could Drop Sharply?

Given recent Sharpe ratio changes, Tron’s (TRX) price may be correct. The Sharpe ratio rising rapidly may indicate that the market is overvaluing the asset, which generally predicts a price drop. This correction could cause a sharp price decline as traders and investors modify their expectations and cut profits. Tron market sentiment will determine if a price crash is imminent. Price may sharply reverse if market players recognize TRX’s risk-return profile is no longer sustainable. Liquidation events and profit-taking may accelerate.

Also Read: Fantom Price Rises 63% above $1 What’s Next?