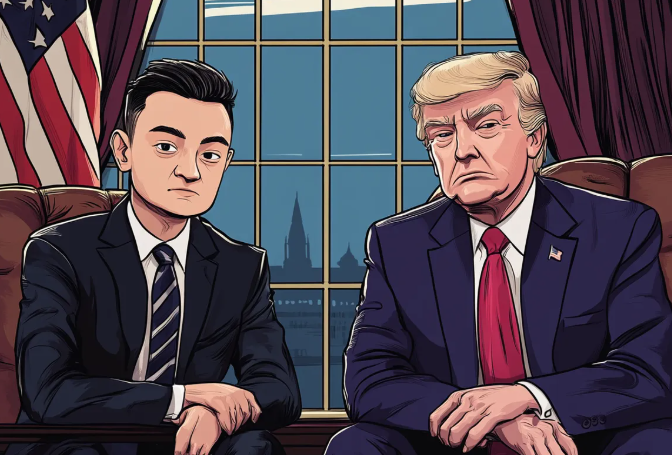

Justin Sun, founder of TRON, recently unveiled USDD 2.0, a revamped version of his algorithmic stablecoin, as he becomes a prominent investor in Donald Trump’s cryptocurrency project, World Liberty Financial (WLFI). This $30 million investment not only cements Sun’s position in the DeFi market but also intertwines with political and financial complexities surrounding Trump’s return to influence.

Justin Sun, a crypto entrepreneur, recently grabbed headlines for eating $6.2 million worth of banana art, which he won from Sotheby’s Auction House. Now, he’s once again making news by announcing USDD 2.0, a new iteration of stablecoin.

USDD 2.0 A Shift in Stablecoin Design

USDD 2.0 marks a shift from algorithmic dependence to a hybrid backing model that integrates real-world assets and reserve diversification. Sun aims to address the instability of algorithmic stablecoins, a lesson from the collapse of Terra’s UST in 2022. This new model supports wider use cases in decentralized finance (DeFi), including collateralized loans and liquidity pools, while maintaining Sun’s vision for stablecoin growth in a regulatory framework.

Justin Sun introduced a mixed collateral concept to stablecoins in USDD 2.0. Instead of using algorithms, this improvement uses real-world asset backing and diversified reserves to reduce volatility and increase stability. The revamp learns from algorithmic stablecoin failures like Terra’s UST, which crashed in 2022, upsetting investor confidence.

USDD 2.0’s modified structure improves its use in decentralized finance (DeFi), especially collateralized lending and liquidity provisioning. It includes regulatory measures to build market trust. Since TRON competes with stablecoins like USDT and USDC, this progression is crucial. Sun aims to increase blockchain-based financial system use cases and solve stablecoin model obstacles, setting a new crypto industry benchmark.

Trump’s WLFI and Sun’s Role

Sun’s purchase of $30 million in WLFI tokens comes as the project struggles to meet its ambitious $300 million fundraising target. WLFI positions itself as a “freer and fairer finance” platform, advocating minimal regulatory oversight in line with Trump’s campaign promises. This investment also makes Sun an official adviser to WLFI, further intertwining his blockchain ambitions with political narratives. Trump’s family members are designated “Web3 ambassadors” for the project, leveraging his platform to promote broader blockchain adoption.

Justin Sun has invested $30 million in Donald Trump’s blockchain initiative, World Liberty Financial Initiative (WLFI), putting himself as a crucial stakeholder in the ambitious cryptocurrency venture. WLFI, a “freer and fairer financial ecosystem,” supports Trump’s minimum regulation and financial independence.

Beyond money, Sun advises on the initiative. Trump-branded WLFI seeks $300 million to boost blockchain usage and attract investors. Trump’s family members are “Web3 ambassadors,” using his platform to promote blockchain in politics.

The venture is criticized for token restrictions and lack of transparency. Sun’s SEC lawsuits raise concerns about the project’s long-term viability. Despite the controversy, Sun’s contribution highlights his strategy to make blockchain a cornerstone of U.S. financial innovation.

Criticism and Legal Complications

While the collaboration between Sun and Trump stirs excitement in crypto circles, it’s not without scrutiny. WLFI’s restrictive token sales policies and lack of transferability have raised investor concerns. Sun’s legal battles with the SEC, including accusations of unregistered securities sales and market manipulation, compound skepticism around the venture.

Justin Sun and Donald Trump’s World Liberty Financial (WLFI) have caused controversy. WLFI’s non-transferable tokens and limited investor flexibility violate decentralization, according to critics. The project’s $300 million fundraising goals have been slow to materialize, prompting concerns about its profitability and sustainability.

Sun’s legal difficulties increase scrutiny. The SEC has accused him of unregistered securities sales and market manipulation, casting a cloud on his business dealings. His $30 million investment in WLFI supports his goal of making the U.S. a blockchain hub, but also raises questions about financial innovation and political interference. These issues demonstrate the delicate balance between crypto acceptance and regulatory and ethical issues.

Implications for the Crypto Sector

Sun’s investment reflects his belief in the U.S. as a burgeoning blockchain hub, a sentiment echoed by Trump’s crypto advocacy. However, the intersection of political influence, regulatory uncertainty, and financial innovation sets a contentious stage for both WLFI and USDD 2.0 as they navigate market and legal challenges.

In summary, the dual launch of USDD 2.0 and Sun’s WLFI involvement showcases a dynamic yet controversial evolution in blockchain projects. While these initiatives highlight innovation, their success hinges on overcoming regulatory scrutiny and fostering broader investor trust.

These developments reflect both opportunities for advancing blockchain adoption and the risks of intertwining financial innovation with contentious figures and regulatory challenges, making the crypto sector’s future increasingly complex yet pivotal.

Read More: XRP Fund Flows Rise 353% in One Week

Conclusion

But Sun’s relationship with Trump-backed WLFI shows how blockchain innovation is becoming politicized. By using Trump’s influence, the alliance may boost adoption but also raise scrutiny. Sun’s SEC legal issues and WLFI’s token restrictions impede its success. These instances demonstrate how innovation drives crypto industry growth and regulatory complexity balances it. Sun’s initiatives address both revolutionary growth and the ethical and legal issues of the industry’s rapid evolution. As blockchain technology transforms global financial systems, stakeholders must be careful and balanced in adoption.

[sp_easyaccordion id=”2535″]