Recent advances in Bitcoin can be attributed, at least in part, to shifts in the political climate, particularly from the United States of America. Cryptocurrencies are receiving support from the incoming president of the United States, Donald Trump, which has sparked increased market growth momentum among investors. The policies that he enforces provide Bitcoin with an excellent outlet for growth in a new landscape that is becoming increasingly open and welcoming.

These policies range from revisions in regulatory structures to a proposal for a national Bitcoin reserve. The United States of America is now in a strategic position to become the world’s leader in crypto innovation, and these changes have created an environment conducive to the continued market growth momentum of Bitcoin.

Rise of Cryptocurrency

Participants in the market have shown a positive response to these potential developments, as evidenced by the fact that Bitcoin now holds the highest market dominance at 59%. It is possible that a bill that is currently being drafted would make it possible for state-chartered banks to mint stablecoins without first obtaining approval from the Federal Reserve. This would place the United States in a very dominating position in the competition to dominate market innovation in the financial sector. In addition, there is a possibility that efforts to deregulate the energy business will favor cryptocurrency mining. This will put the United States in a better position in the global fight for blockchain technology.

Historic Rally Bitcoin Is Getting Closer to $100K

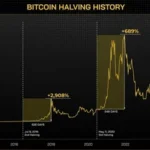

The price of Bitcoin is currently trading at approximately $99,850, and it is on the approach of reaching the long-awaited milestone of $100,000. Some people believe that factors driving this phenomenal appreciation of Bitcoin’s price include institutional interest, favorable economic conditions, and increased on-chain activity. This surge reflects strong market growth momentum, similar to the bull run after the 2020 elections, when Bitcoin’s price nearly doubled in just a few months.

VanEck’s most recent research indicates that Bitcoin is still in the early phases of its climb, and there is very little technical opposition that is preventing it from reaching its goal. This rise appears to be well-positioned to continue at this point because investor enthusiasm is growing, there are growing calls for the alpha coin to be approved as a strategic reserve, and the United States government is supportive of the cryptocurrency. Those who are knowledgeable with Bitcoin are optimistic that it will continue to advance and reach new heights.

VanEck’s most recent research indicates that Bitcoin is still in the early phases of its climb, and there is very little technical opposition that is preventing it from reaching its goal. This rise appears to be well-positioned to continue at this point because investor enthusiasm is growing, there are growing calls for the alpha coin to be approved as a strategic reserve, and the United States government is supportive of the cryptocurrency. Those who are knowledgeable with Bitcoin are optimistic that it will continue to advance and reach new heights.

Outlook For Bitcoin Positive And Cautious

Analysts concede that momentum is strong but point out that the market may be running too hot. Early signals in the development of this phenomenon include rising funding rates and unrealized profits. However, even at this stage, long-term prospects look bright due to strong institutional demand, robust on-chain metrics, and supportive legislative developments.This is according to the projection of $180,000 that VanEck has made for Bitcoin in the current cycle.

Despite the fact that historical statistics may suggest that the rise of the crypto asset is slowing down as the markets mature, the cryptocurrency nevertheless demonstrates promising prospects in the short run. In the meantime, this surge has demonstrated the confidence of investors and has gradually gained recognition for the role that Bitcoin plays in a financial industry that is undergoing significant upheaval.

Also Read: Bitcoin Prodigy? Kiyosaki Backs Saylor’s Risky Move

In Summary

This essay explores how political changes, especially in the US, have accelerated the emergence of Bitcoin. President Donald Trump’s policies, such as proposed national Bitcoin reserves and regulatory improvements, position the United States to take the lead in cryptocurrency innovation. Because of this, Bitcoin has dominated the market and has a promising future; it is now close to $100,000.

Deregulation, especially in the banking and energy sectors, institutional interest, and favorable economic conditions are fueling its growth. Although market overheating is a concern for observers. Bitcoin’s long-term prospects are still bright. With projections indicating it may hit $180,000. All things considered, the rise of Bitcoin is a reflection of rising investor confidence and awareness of its significance in a changing financial industry.

FAQs

How is Bitcoin approaching the $100K milestone?

Bitcoin is nearing the $100,000 mark, driven by institutional interest, favorable economic conditions, and increased market optimism.

What are the key factors supporting Bitcoin’s market growth momentum?

Regulatory changes, support for cryptocurrency mining, and proposed national Bitcoin reserves are fueling Bitcoin's market growth momentum.

What is the outlook for Bitcoin in the near future?

While analysts caution about market overheating, Bitcoin's long-term prospects are positive, with projections reaching $180,000 due to strong institutional demand and supportive legislation.

How does Bitcoin's rise reflect investor confidence?

Bitcoin's surge in value demonstrates growing investor confidence and its increasing role in the evolving financial landscape.