Bitcoin’s Wild Ride Divides The crypto market has been active this week, with Bitcoin hitting a record $99,800 per coin on Thursday. Data shows South Korea had a distinct local discount on BTC pricing while the Coinbase premium rose. Bitcoin, the flagship cryptocurrency, has seen price swings between highs and lows. Investors, analysts, and regulators have noticed this change, underscoring the volatility of cryptocurrencies in 2024.

Since Bitcoin trading is 24/7, unlike traditional markets that close at a specific hour, the relationship between Bitcoin’s price and exchange-traded funds (ETFs) net asset value (NAV) has been central to this phenomenon. According to data from cryptoquant.com, the Coinbase premium index has been showing a positive premium since Nov. 3.

This trend indicates strong buying interest among U.S. investors, typically fueled by institutional participation. Additionally, a premium can hint at large-scale investors (whales) snapping up BTC despite its elevated prices. Meanwhile, the Korea Premium Index (KPI), also known as the “Kimch” Premium,” has “been running at a discount.

What Drives Bitcoin’s Swings

Several factors influence Best Bitcoin ETFs‘ rise and associated premiums and discounts. One of the most significant is the market’s implementation of regulatory changes, particularly approving more spot Bitcoin ETFs. The potential approval of these ETFs has stirred optimism in the market, leading to a rally in Bitcoin. However, the market is also cautious, as any setbacks in regulatory approval or changes in broader economic conditions could lead to price corrections.

Furthermore, the Bitcoin halving event scheduled for 2024 could substantially impact Bitcoin’s supply and demand dynamics. This event reduces the reward for mining Bitcoin, which historically has led to price increases due to the anticipated reduction in Bitcoin’s rate. If the market reacts positively to the halving event, Bitcoin could see another upward surge, further influencing ETF premiums and discounts.

Market Effects of Bitcoin Price Differences

Institutions and large investors closely monitor these trends since they could affect Bitcoin’s class stability. A prolonged premium or discount may suggest market inefficiencies, deterring institutional Bitcoin ETF adoption. SEC regulation is vital in countries like the U.S., where Bitcoin ETFs are gaining popularity. The SEC’s ETF and cryptocurrency regulation decisions will determine whether these premiums and discounts stabilize or stay erratic.

Institutional Interest and Market Sentiment

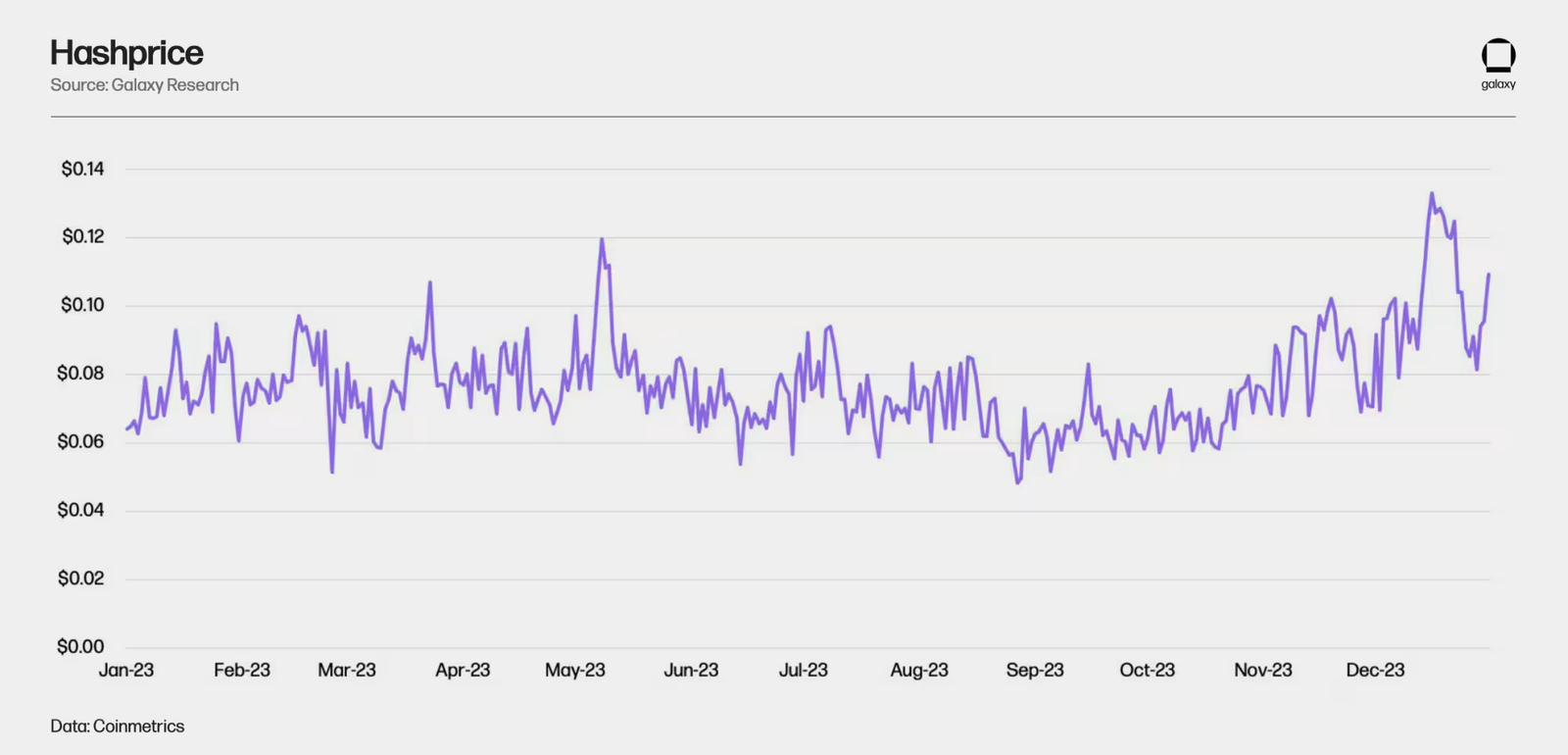

Bitcoin has risen due to institutional interest, especially in 2023 and 2024. Large financial institutions and ETFs have increased Bitcoin exposure, improving liquidity and acceptance. In Q4 2023, institutional trading volumes increased 92%, driven by corporations like BlackRock launching Bitcoin investment vehicles. Institutional backing has supported Bitcoin’s appreciation and raised expectations of sustainable growth.

Institutional investors also affect Bitcoin volatility. During market changes like uncertainty about worldwide regulation or significant price corrections, huge holders, or “whale,” can “trigger dramatic market shifts and price swings. This uncertainty makes smaller investors pause or modify their positions based on market direction.

Global Market Divisions and Price Fluctuations

Despite Bitcoin’s promising outlook, its wild price swings have led to divisions within global markets. On one side, some investors believe Bitcoin is headed toward $100,000 and beyond, driven by its increasing adoption and institutional backing. Conversely, some skeptics question its sustainability, particularly regarding regulatory uncertainty and the potential for market corrections.

These opposing views are reflected in Bitcoin’s actions. For instance, during periods of strong upward momentum, Bitcoin experiences “premiums,” where” the price spikes due to overwhelming buying pressure. Conversely, Bitcoin can trade at a “disco during corrections or sell-offs,” with the price dropping sharply as market sentiment shifts.

Conclusion

Bitcoin’s upward $100,000 in 2024 exemplifies the cryptocurrency market’s ongoing volatility and excitement. For some, bitcoin represents the future of finance, while others remain cautious due to the inherent risks. Regardless of the outcome, Bitcoin’s journey will undoubtedly play a pivotal role in shaping the future of cryptocurrencies and global financial markets. Bitcoin’s price movements in 2024 have highlighted its continued volatility, dividing global markets into two camps.

Institutional interest and the halving event have some people expecting Bitcoin to reach $100,000. Skeptics warn that the competitive nature and regulatory uncertainties could cause significant corrections. Premiums and discounts fluctuate due to this uncertainty, with major investors—”whales”—dictating market mood. Whether Bitcoin will continue to rise or fall, its significance in global markets will change, affecting cryptocurrencies and traditional financial institutions.