Blockchain gaming technology’s merger with the metaverse has created fresh opportunities for tokenizing real-world assets (RWAs). Digitalizing real-world assets into tradable tokens will help companies improve asset management, increase liquidity, and open investor access. The main actions to create a metaverse platform aimed toward RWA tokenization are described in this paper.

Tokenization Assets to Digital Tokens

Tokenizing is turning tangible objects—such as real estate, artwork, or commodities—into digital tokens on a Blockchain abstraction. These tokens show ownership shares, therefore allowing fractional ownership and simpler trading and transfer. This procedure improves liquidity and distributes access to investing possibilities.

Define Assets and Objectives

Clearly state the particular assets to be tokenized as well as the platform’s particular objectives. Choose whether the platform will present a wide variety or concentrate on a certain asset class. Set goals including improving liquidity, drawing a worldwide investment base, or interacting with current financial systems.

Select the Ideal Blockchain Platform

Select a blockchain system fit for the needs of your platform. Think through elements including scalability, security, transaction speed, and smart contract compatibility. Because of their strong ecosystems and support of distributed applications, popular alternatives for asset tokenization are Ethereum, Polkadot, and Hedera.

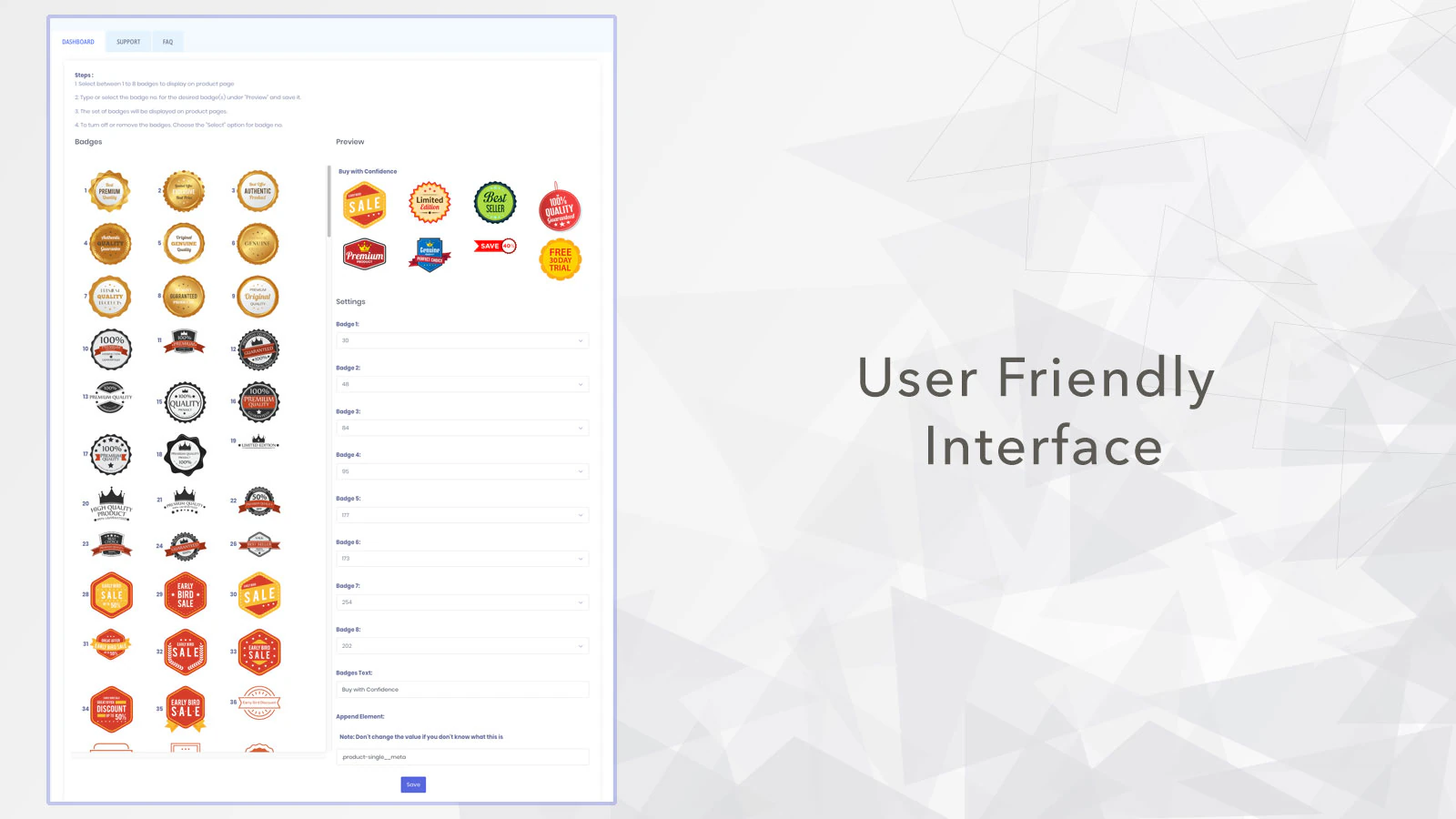

Design a User-Friendly Interface

Create a user-friendly interface so that users may interact with the platform with simplicity. Token generation, asset listing, trading, and portfolio management should all be facilitated by the UI. To improve the user experience, include tools such as real-time data analytics, safe wallet integration, and instructional materials.

Prioritize Security and Compliance

Integrate Tokenized Assets into the Metaverse

Integrate the platform into virtual worlds where users may interact with tokenized objects in immersive situations to completely utilize the metaverse. Virtual markets, art galleries, or real estate tours might all be part of this, increasing user involvement and offering a fresh experience.

Ensure Compliance with Regulations

Make sure the platform conforms with appropriate rules and regulations in all operational countries to guide the convoluted regulatory terrain. Following financial rules, anti-money laundering (AML) policies, and know-your-customer (KYC) criteria counts here. See lawyers to create an all-encompassing compliance system.

Tokenomics Framework

Provide a coherent tokenomics model outlining token production, distribution, and utility inside the platform. Choose elements including user incentives, pricing systems, and token supply. Maintaining platform improvement and user involvement depends on a well-organized tokenomics approach.

Build Strategic Partnerships

Form alliances with technological companies, attorneys, and financial institutions to improve the legitimacy and usefulness of the platform. Cooperation can guarantee the platform satisfies industry criteria, give access to a larger user base, and provide more tools.

Test and Launch

Test thoroughly before starting to find and fix possible problems. Apply beta testing stages to get user comments and make required changes. Once testing is over, arrange a deliberate introduction to draw users and investors together and support marketing initiatives highlighting the special qualities of the platform.

Final thoughts

Constructing a metaverse platform for real-world asset tokenization calls for a calculated strategy combining technical innovation with thorough knowledge of financial markets and user experience. Following these guidelines will help companies build a platform that not only helps tokenize assets but also provides an interesting and safe space for people to invest and interact in the metaverse.