MARA Holdings Buys Bitcoins With 0% Convertible Notes

With the help of its issuance of 0% convertible senior notes, Mining company MARA has been able to financially support its Bitcoin procurement and other company activities. In its latest offering, the company secured a total of $1 billion in financing, generating net proceeds of $980 million, after tax and discount deductions. A portion of those proceeds was subsequently deployed in acquiring 5,771 Bitcoins at an average price of $95,554 per Bitcoin. Thus, MARA has concretized its objective to hold Bitcoin as a store of value in the business context.

Hence, with its current Bitcoin position of approximately 33,875 Bitcoins. The company has taken its place among the largest Bitcoin-holding miners in the industrial realm. Most likely, owing to the very aggressive expansion approach of Bitcoin accumulation, the company has reported a 35% BTC yield per share, which provides a clearer picture of such a strategy. MARA buys BTC through the issuance of zero-coupon convertible senior notes, avoiding the burden of immediate interest payments and instead focusing on expanding its Bitcoin stockpile and mining activities.

Bitcoin Rallies Toward $100k

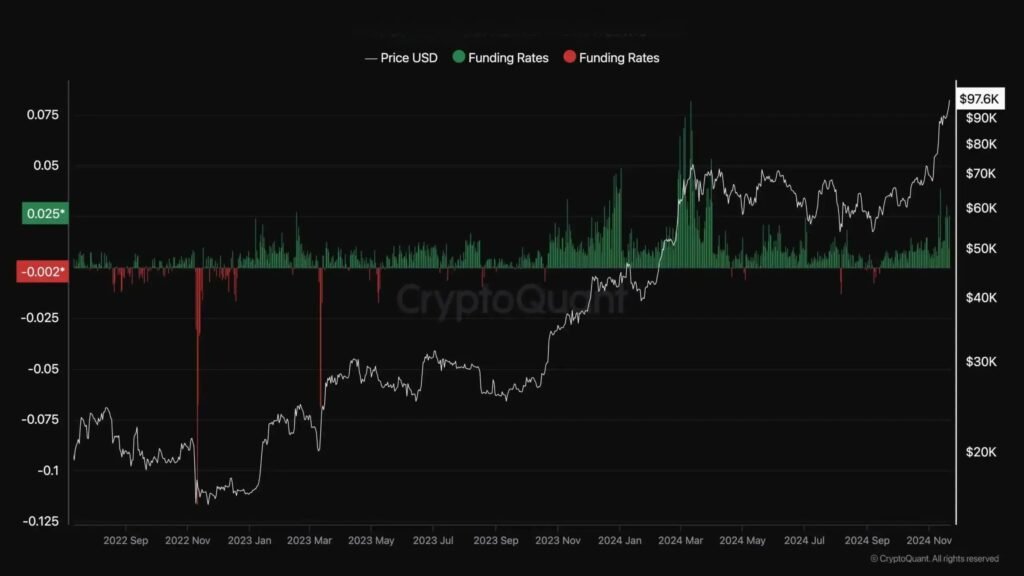

World media should go berserk as Bitcoin, the top cryptocurrency, approaches $100,000 again. Due to market anomalies, institutional acceptance, and macroeconomic developments, Bitcoin’s continuous increase reflects renewed faith in digital assets. Bitcoin mining rewards will halve in 2024, reducing new Bitcoin production. Scarcity, retail, and institutional buying are pushing Bitcoin values into unknown territory. Bitcoin’s institutional acceptance and regulatory recognition as a viable asset class have boosted investor enthusiasm. Market watchers note that the increase is supported by growing interest in decentralized financing (DeFi) and blockchain technologies.

Bitcoin is more desirable because innovations like Lighting Network make daily transactions more scalable and efficient. Price swings still present issues. One significant element is Bitcoin’s volatility, but regulatory changes and macros underlying instability may heavily influence its paths. This leaves retail investors and analysts bullish. Progress towards $100,000 marks a milestone in Bitcoin pricing and increases acceptance of cryptocurrencies as a potential force for financial reform. Supply issues and institutional interest drive Bitcoin’s entrepreneurial journey toward a value renaissance.

Bitcoin is more desirable because innovations like Lighting Network make daily transactions more scalable and efficient. Price swings still present issues. One significant element is Bitcoin’s volatility, but regulatory changes and macros underlying instability may heavily influence its paths. This leaves retail investors and analysts bullish. Progress towards $100,000 marks a milestone in Bitcoin pricing and increases acceptance of cryptocurrencies as a potential force for financial reform. Supply issues and institutional interest drive Bitcoin’s entrepreneurial journey toward a value renaissance.

Marathon Digital Follows Saylor’s Growth Strategy

Mining company MARA, heavily inspired by Michael Saylor of MicroStrategy, one of the most vocal supporters of Bitcoin and a company striving to reserve Bitcoin in their coffers, has taken a step to follow his modes of averting average price inflation for gaining profit. With his approach to dip buying, Saylor encouraged companies to leverage their future earnings to fund those purchases of BTC for holding on to long-term. The performance of MARA also relies on the same concept of buying BTC through convertible notes in support of its investments in Bitcoin-acquisition operations, retaining enough inventory of BTC, to later convert them as a safe-haven asset for appreciation in the long run and as a safeguard against inflation.

Additionally, MARA plans to use the proceeds from its convertible note offering to invest in mining operations, strategic acquisitions, and debt repayment, further increasing exposure while managing cash flow viability. The company has also engineered itself such that it relishes the appreciation of Bitcoin considering it as an inflationary hedge and store value. While also accumulating Bitcoin, MARA plans on allocating some of the proceeds from the convertible note offering to invest in equipment that will expand its mining operations, make strategic acquisitions, and pay off debt. It thus increases the exposure while allowing room for cash flow viability.

Regulatory And Institutional Demand Boost Bitcoin

The rise in business interest in Bitcoin is coinciding with surging optimism over regulatory clarity and the potential launch of a U.S. spot Bitcoin ETF. The expected inflow into the Spot ETF will increase demand and provide Bitcoin with access to traditional investors. Sen. Cynthia Lummis of the United States has put forth a recent suggestion that this would ultimately help reduce the national debt in the coming 20 years. This sets the stage that could spur additional adoption, as corporate and institutional players like MARA continue to fortify their stakes in the crypto asset.

[sp_easyaccordion id=”1564″]