Schiff warns of Bitcoin meltdown, forecasting another potential BTC crash. Learn why the economist believes Bitcoin’s value could take another hit and what it means for investors. Bitcoin (BTC), long considered the future of money and a store of value, has had a rough few months. In this uncertain climate, well-known economist and Bitcoin critic Peter Schiff predicts a further price fall.

Schiff’s comments have again drawn the attention of crypto enthusiasts and financial professionals due to his longstanding mistrust of cryptocurrency. In this post, we’ll investigate Peter Schiff’s warning, his view on Bitcoin, and how this crash might affect BTC and the cryptocurrency industry. This detailed research will benefit Bitcoin investors and digital currency enthusiasts alike.

Who is Peter Schiff?

Peter Schiff, a notable economist and financial pundit, is vocal about gold, the dollar, and cryptocurrencies. Schiff became famous in 2008 for anticipating the housing market crash and economic depression. He is CEO of Euro Pacific Capital, a foreign market and precious metals investment advice organization. Schiff has long criticized Bitcoin as a speculative asset rather than a store of wealth. His opinions on Bitcoin have been controversial, especially considering its significant climb in value over the previous decade. Schiff’s fresh statements have revived speculation about Bitcoin’s long-term prospects.

Schiff predicts a bigger Bitcoin crash

Peter Schiff has long expressed skepticism about Bitcoin, often claiming that it has no inherent worth and its price is exaggerated. His most recent comment implies that the worst may yet be in store for Bitcoin investors since he has repeatedly forecast that the cryptocurrency will eventually fall. He claims that the current declines in the price of Bitcoin are only the beginning.

Schiff believes that Bitcoin is wildly overpriced and that its value will continue to decline as more investors understand that virtual currency is a speculative bubble rather than a haven investment. Schiff’s perspective stems from his conviction that Bitcoin lacks the essential characteristics such as scarcity and historical stability that give conventional commodities like gold their value.

Schiff believes that Bitcoin is wildly overpriced and that its value will continue to decline as more investors understand that virtual currency is a speculative bubble rather than a haven investment. Schiff’s perspective stems from his conviction that Bitcoin lacks the essential characteristics such as scarcity and historical stability that give conventional commodities like gold their value.

Schiff’s more general criticism of the cryptocurrency sector is linked to his pessimistic view of Bitcoin. He contends that excitement and market speculation, rather than any intrinsic worth, are what drive Bitcoin’s price swings. Although many have praised Bitcoin’s decentralized structure and blockchain technology, Schiff is not sure that these aspects can maintain its value over time.

Schiff expects a Bitcoin crash why?

No intrinsic value

The lack of inherent value is Schiff’s main critique against Bitcoin. Bitcoin is digital, unlike gold, which has been used as a store of value for hundreds of years and has many industrial and economic uses. Schiff calls Bitcoin a speculative asset, not a steady investment. Schiff believes gold is valuable because it is rare, durable, and accepted in many sectors. Bitcoin, however, is unrelated to actual assets or economic activities. Schiff thinks Bitcoin will fall in price once investors understand it’s just volatility.

Bitcoin’s Volatility

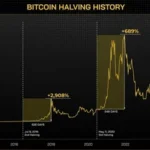

Bitcoin’s price is notoriously volatile. Bitcoin has dropped and risen by big amounts in 2024 alone. Schiff says Bitcoin’s volatility renders it unfit as a store of wealth or means of trade. Schiff believes Bitcoin’s price oscillations show that it’s a speculative trading instrument rather than a steady financial asset. Bitcoin’s volatility will deter investors seeking security and consistency, causing additional price drops, he claims.

“Bubble” Theory

Schiff has likened Bitcoin to speculative bubbles like the 1600s Dutch tulip mania and the late 1990s dot-com boom. He compares Bitcoin’s spectacular growth to past bubbles, fuelled by irrational enthusiasm and speculation. Schiff believes Bitcoin’s valuation is unsupported by economic considerations, making it vulnerable to a meltdown. He expects that Bitcoin’s price will plummet as the speculative excitement subsides, causing investors to lose a lot.

Market Manipulation

Schiff accuses Bitcoin of market manipulation. He mentions a few “whales”’ enormous Bitcoin holdings. Schiff says these whales may increase Bitcoin volatility by buying and selling large sums. The concentrated ownership of Bitcoin and the lack of cryptocurrency regulation make Schiff think manipulation is conceivable. Whales selling assets may scare smaller investors with additional dips.

Limited Adoption

Schiff claims that Bitcoin has not become a mainstream money or store of value despite its popularity and rising acceptance. Some companies and institutions accept Bitcoin, although its use is restricted compared to major currencies like the dollar and euro. Schiff thinks Bitcoin’s lack of broad adoption hinders its growth. Without broad use, Bitcoin’s price will continue to fall.

What about Bitcoin investors?

Schiff’s forecasts are concerning for Bitcoin investors. Although the price of Bitcoin has increased significantly in recent years, it is still a dangerous investment due to its volatility and speculative character. Investors who have made significant investments in Bitcoin might suffer significant losses if Schiff’s prediction comes to pass and the cryptocurrency plummets much further.

Short-Term Impact

Due to speculative trading and responses to market developments, the price of Bitcoin may continue to vary soon. As in the past, investors in Bitcoin may see periods of steep price losses followed by quick price gains. A sell-off and more downward pressure on the market might result from investors’ anxieties being heightened by Schiff’s warning of another catastrophe.

Long-Term Impact

The future of Bitcoin will rely on several variables, including changes in regulations, advances in technology, and the degree of consumer and corporate acceptance. Schiff’s prediction of a crash may come to pass if Bitcoin is unable to acquire broad adoption and has ongoing volatility. In contrast, Bitcoin’s value may stabilize and even rise in the future if it can overcome these obstacles and become a more reliable and well-liked asset. This is still up in the air, though, and Schiff’s cautions underscore the dangers of Bitcoin investing.

Also Read: Bitcoin Experts Call the $93K Drop the ‘Last Flush’ before the Rush

In Summary

Only time will tell if Schiff’s pessimistic forecast comes true or if Bitcoin can overcome its obstacles and realize its promise as a store of value as the cryptocurrency sector develops further. Investors in Bitcoin should, for the time being, keep an eye on market developments, be educated, and proceed cautiously when dealing with the cryptocurrency, particularly given the possibility of more price drops.

[sp_easyaccordion id=”2262″]