In 2024, Ethereum has been in the news once more. Many investors and cryptocurrency aficionados are left wondering, “Why is Ethereum up today?” in light of its recent price spike. “Will it reach $10,000?” In this piece, we examine the causes of Ethereum’s ascent as well as its possible future course. Ethereum’s price has been rising at an astonishing rate lately, attracting the interest of both new and seasoned cryptocurrency investors. What is causing this spike, though, and more significantly, is it likely to reach $10,000 soon? Let’s dissect it.

Ethereum’s Price Surge in 2024

Ethereum’s price has risen significantly in 2024. This boom is due to institutional interest, DeFi expansion, and Ethereum’s technological developments. Ethereum 2.0, which switched from PoW to PoS, improved scalability and energy efficiency, enticing investors. Ethereum’s utility has grown due to dApps and smart contract utilization, making it a key blockchain player. Ethereum’s recent price increase is tied to a cryptocurrency market recovery as investor optimism improves. While the outlook is favorable, Ethereum’s long-term performance will depend on its planned upgrades and market conditions.

Will Ethereum Reach $10,000?

Ethereum’s $10,000 milestone is a hot issue in the crypto community. Ethereum has grown significantly, but reaching $10,000 would require multiple favorable situations. The Ethereum 2.0 upgrade and ecosystem development are key factors. ETH demand may rise as the network grows more scalable, secure, and energy-efficient, attracting developers, users, and institutional investors.

Ethereum is also valued more due to its growing dominance in decentralized finance (DeFi) and non-fungible tokens (NFTs). Market trends, favorable legislation, and investor interest are still needed to reach $10,000. It’s not certain, but Ethereum’s solid underpinnings and continual advancements make it possible.

Ethereum is also valued more due to its growing dominance in decentralized finance (DeFi) and non-fungible tokens (NFTs). Market trends, favorable legislation, and investor interest are still needed to reach $10,000. It’s not certain, but Ethereum’s solid underpinnings and continual advancements make it possible.

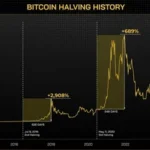

Historical Trends and Future Projections

Throughout its history, Ethereum has demonstrated that it is a robust asset. After going through a period of severe instability, the price of Ethereum has experienced notable inflation, particularly during periods of market expansion. Under the assumption that the market continues to be favorable and that Ethereum’s upgrades continue to be successful, reaching $10,000 may become realistic within the next few years.

Factors That Could Lead to $10,000

The price of Ethereum could reach $10,000 due to a number of variables. A number of factors have contributed to the widespread acceptance of applications based on Ethereum, the extensive usage of Ethereum in decentralized finance, the growing interest from institutional investors, and an overall good market outlook for cryptocurrencies.

Risks and Market Volatility

Ethereum, on the other hand, is highly susceptible to a number of significant risks. In addition to the high degree of volatility that characterizes cryptocurrency markets, the expansion of the cryptocurrency could be hampered by regulatory issues. There is a possibility that the dream of reaching $10,000 may remain unrealistic in the event that there is a change in the mindset of the market or if Ethereum is unable to scale in an appropriate manner.

Competition Ethereum vs Bitcoin

Even though Ethereum has experienced remarkable growth, it is still in rivalry with Bitcoin for the title of the most prominent cryptocurrency. Bitcoin is currently the dominant cryptocurrency. Among the tough competitors is Bitcoin, which is a formidable competitor because to the network effects it possesses and its reputation as a store of wealth. To differentiate itself from other cryptocurrencies and to maintain its growth trajectory, Ethereum must continue to innovate. This is necessary in order to protect its growth trajectory.

Long-Term Growth Potential of Ethereum

When viewed over a longer period, Ethereum has the potential to realize significant growth. In the event that Ethereum 2.0 continues to expand and obtains an increasing amount of investment from institutional investors, Ethereum has the potential to establish itself as a leading institution in the blockchain and cryptocurrency industries for many years to come. This is contingent upon Ethereum receiving an increasing amount of investment from institutional investors. This is something that could happen at some point in the future.

Also Read: Solana Crushes Ethereum in Volume Blockchain Scalability

Conclusion

As a conclusion, the key causes that are fueling the current surge in Ethereum are the advancements in technology, the growing demand for decentralized applications, and the expansion of decentralized financial systems. Predicting whether or not Ethereum will hit $10,000 is a question of guesswork; nonetheless, the potential is certainly evident, provided that it is able to successfully overcome the challenges that are still to come. The future of Ethereum appears to be bright, and there is no denying the role that it will play in shaping the future of finance. In the long run, Ethereum appears to have a bright future.

[sp_easyaccordion id=”2032″]